Merchant

Corporate

Blog

FAQ

The exact Tools You

Need for Processing

Payments

Simplify payments with our convenient online and mobile checkout

Easy and handy solution to suit needs of your business

01

Apply online

02

Fast set up

03

Multiple currencies

The exact Tools You Need for Processing Payments

Simplify payments with our convenient online and mobile checkout

Easy and handy solution to suit needs of your business

01

Apply online

02

Fast set up

03

Multiple currencies

new source for you to increase your revenue

Payment Solutions

Mass payouts

Acquiring services

Global payment methods

Security for our customers

24/7 support

Fraud and risk management

Payments reporting

Seamless integration

Fast API setup

Compatible with major platforms

Customizable checkout

Multicurrency support

Payments in multiple currencies

Automatic currency conversion

Transparent exchange rates

Payment Solutions

Mass payouts

Acquiring services

Global payment methods

Security for our customers

24/7 support

Fraud and risk management

Payments reporting

Seamless integration

Fast API setup

Compatible with major platforms

Customizable checkout

Multicurrency support

Payments in multiple currencies

Automatic currency conversion

Transparent exchange rates

Prompt Payments for any occasion

Personalise your experience

Work with global audiences and grow your business by giving the clients an option to choose payment types and a vast range of currencies

Hasty connection

Practice our simple eCommerce solutions to begin accepting payments immediately with the systems you already operate with

Effortless integration

Start and work swiftly with our no-trouble-to-integrate API and library of SDKs for the web and mobile applications developed by our team

Personalise your experience

Work with global audiences and grow your business by giving the clients an option to choose payment types and a vast range of currencies

Hasty connection

Practice our simple eCommerce solutions to begin accepting payments immediately with the systems you already operate with

Effortless integration

Start and work swiftly with our no-trouble-to-integrate API and library of SDKs for the web and mobile applications developed by our team

No need to build a website

With ExePay, your clients can quickly process their invoices on a webpage secured and generated by our payment platform.

Payments around the Globe

ExePay provides you with a swift system so that you can get paid by customers from all over the world. We put an effort into making it available for people to pay in their local currencies and via their preferred payment types.

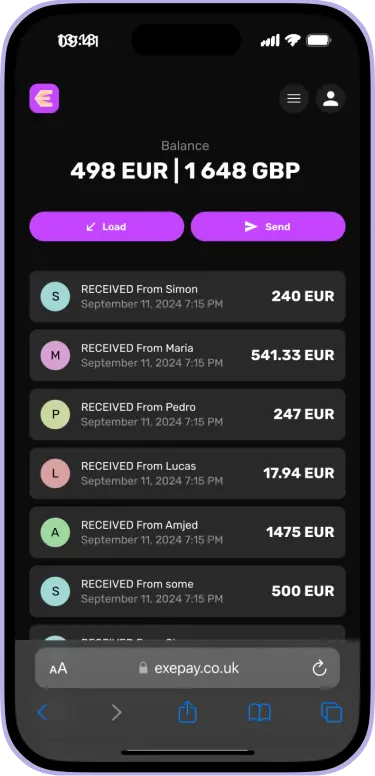

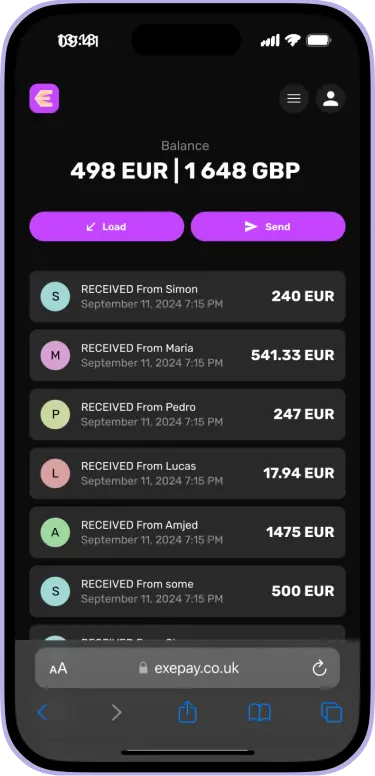

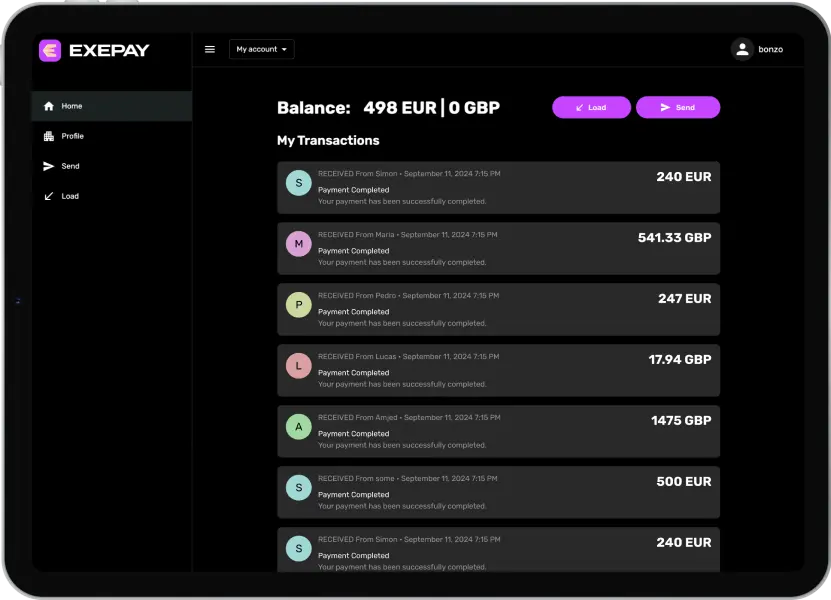

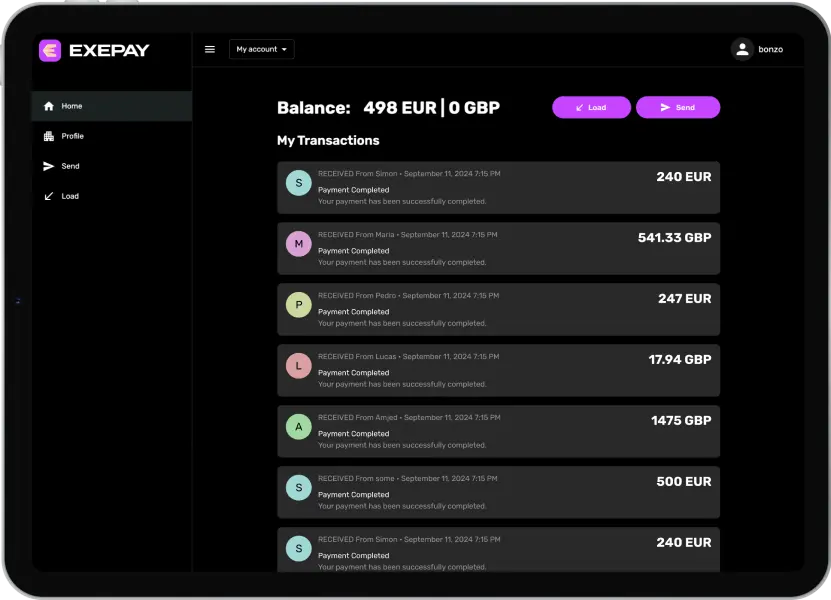

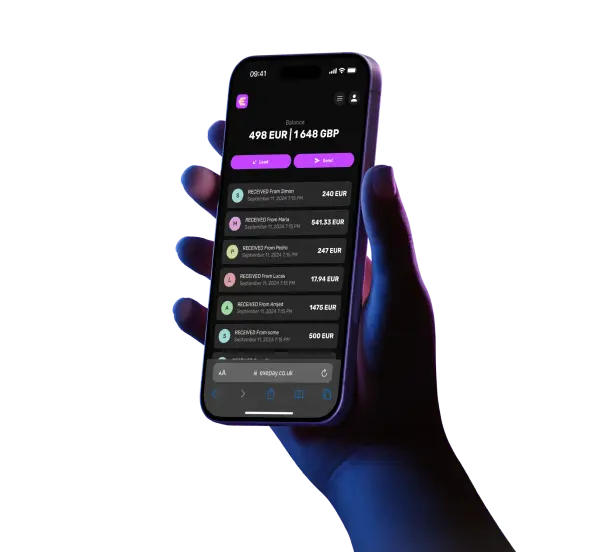

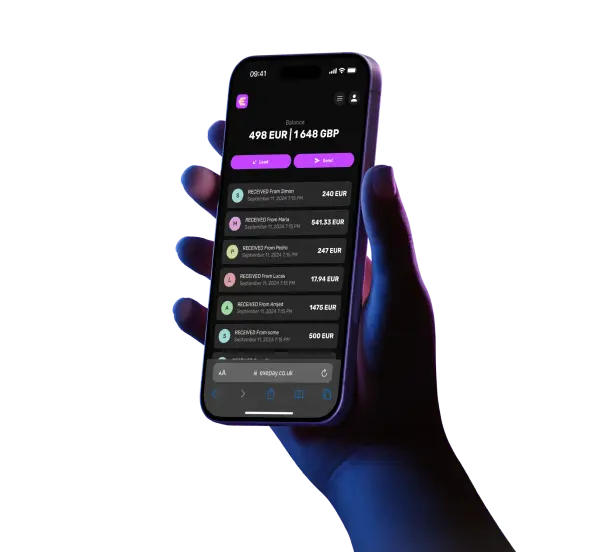

Backoffice on your mobile device

Create payment orders and invoices wherever you are using our handy app. You can manage your clients, payments, and other information on the go.

Payments around the Globe

ExePay provides you with a swift system so that you can get paid by customers from all over the world. We put an effort into making it available for people to pay in their local currencies and via their preferred payment types.

No need to build a website

With ExePay, your clients can quickly process their invoices on a webpage secured and generated by our payment platform.

Backoffice on your mobile device

Create payment orders and invoices wherever you are using our handy app. You can manage your clients, payments, and other information on the go.

Convenient back office at your fingertips

Convenient back office at your fingertips

Steps to opening account online

Start processing payments quickly and easily by following these three simple steps to set up your account, integrate payment systems, and begin accepting transactions worldwide.

Sign Up and Set Up

Register and set up your account to access our online and mobile payment platform, offering secure checkout options.

Integrate Payment Systems

Use our API and SDK library to quickly integrate and start accepting payments on web or mobile.

Start and Get Support

Connect to your existing platforms and start accepting payments right away. Our team is here to assist with any issues.

Sign Up and Set Up

Register and set up your account to access our online and mobile payment platform, offering secure checkout options.

Integrate Payment Systems

Use our API and SDK library to quickly integrate and start accepting payments on web or mobile.

Start and Get Support

Connect to your existing platforms and start accepting payments right away. Our team is here to assist with any issues.

Blog

September 10, 2024

|

4 min

How to Optimize Your Payment Process for Global Clients

Discover how to enhance your payment systems to serve a global audience, offering...

#PaymentIntegration

September 10, 2024

|

4 min

Top 5 eCommerce Payment Solutions for 2024

Find out the best eCommerce payment platforms to keep your business competitive...

#eCommerce

September 8, 2024

|

6 min

API Integration: How to Start Accepting Payments Today

A step-by-step guide to integrating payment APIs into your website or app, helping you ...

#APITech

September 10, 2024

|

4 min

How to Optimize Your Payment Process for Global Clients

Discover how to enhance your payment systems to serve a...

#PaymentIntegration

September 10, 2024

|

4 min

Top 5 eCommerce Payment Solutions for 2024

Find out the best eCommerce payment platforms to keep ...

#eCommerce

September 8, 2024

|

6 min

API Integration: How to Start Accepting Payments Today

A step-by-step guide to integrating payment APIs into...

#APITech

Frequently asked questions

What is the difference between ExePay and banks?

We are a platform which gives you access to a UK and European IBAN account, international investment options, and premium lifestyle support services to help you better manage your financial and lifestyle needs.

Your ExePay account is an electronic money account where you can receive, hold, or send money. It's different from a bank account because:

- you won’t be able to get an overdraft

- you won’t earn any interest

Your IBAN account is facilitated by our banking partners (see Terms & Conditions). Your money is safeguarded, as opposed to protected, under a Financial Services Compensation Scheme.

What are the kind of products/services ExePay offer?

We offer e-money and payment products. The products and services are offered digitally via the ExePay website, and facilitated by our banking partners (see Terms & Conditions). We currently offer:

E-money services:

- Multi-currency account

- Transfers and payments

What type of customer do you serve?

We serve customers who have or aspire to live an internationally-mobile lifestyle, so they can manage their wealth borderlessly and with greater ease. We believe in empowering you to manage your wealth internationally and grow your portfolio.

Where can I access your services?

We allow onboarding onto the ExePay app from the following countries:

- The UK

How do I get a ExePay account?

Please apply online via our website to create an account

What is the difference between ExePay and banks?

During the account opening process, we will require you to take photos of the following via the ExePay app:

• Valid government-issued ID

• Valid proof of address (i.e. any bank statements, utility bills or phone bills issued within the last 90 days) and

• Your face (i.e., a true likeness of yourself as a 'selfie')

Please make sure that the whole document page can be seen in the photos, with your name, your residential address, the date of issue and the issuing authority information clearly shown.

Some tips to ensure that the identity verification goes smoothly:

• Do not take a photo of a photo

• Take a clear photo of your documents, where every detail is legible

• Turn the flash off to avoid glare on your documents

• Take the photos somewhere brightly lit

• Make sure your personal details on your ExePay profile match those on your legal document

• Make sure that the whole document page (including your proof of address) is captured in the photo

To ensure the safety of your account, all devices running the ExePay app must support biometrics (e.g., 'Face ID' on Apple devices).

How do I top up my ExePay account?

Your ExePay account can be topped up by bank transfer or via SWIFT and SEPA transfers.

Can I make a transfer from ExePay?

You can make a transfer in EUR/USD/GBP via local bank transfer to accounts in their respective residencies.

What currencies do you support?

We currently support transactions in USD, GBP and EUR, and will be adding more currencies onto the platform. Stay tuned for more currencies to be available later in the year.

How do I contact you?

You can contact us on any of the following channels. Note our customer service agents work 9am - 5pm UK time excluding bank holidays.

Communications received outside of our support hours will be responded to by email during the next business day.

Telephone UK +44 (0) 2034420259

Email: info@exepay.co.uk

Where is my money stored?

Your money will always be segregated from ExePay finances. Your deposits are held and safeguarded by our banking partners (see Terms & Conditions) in accordance with FCA Safeguarding regulations

What does ExePay do with my ID and other information?

We use your ID information to verify your identity. This is to comply with a financial regulation commonly known as 'Know Your Customer’ (KYC) or 'Customer Due Diligence' (CDD) which are necessary processes to verify your identity. verifying the identity of its clients. This is a common practice amongst financial institutions to protect both the businesses and their customers.

We do not use your personal information for any other purposes.

What if I forget my ExePay account password or the email associated with the account?

To reset your password, simply select "Forgot password" at the login screen and enter the associated email. Once you have received the verification email, follow the instructions to set a new password.

Can I close my ExePay account through the website?

We are sorry to see you go! Is there anything that we can do to help? Please contact our customer support via info@exepay.co.uk and we will do everything we can to assist you.

How much do you charge for your services?

See our Fees Tariff on our website.

We may adjust the prices and the range of products or services provided, but we will make sure to notify our customers prior to doing so.

What happens if I don’t have sufficient balance in my account to pay ExePay's subscription?

You should maintain your balance with us for your subscription of our service.

We reserve the right to stop providing our services to you if you are not able to maintain the balance to pay the fee.

How do I file a complaint?

We are sorry you feel the need to raise a complaint. Please send us an email us at info@exepay.co.uk and we will get back to you.

If you don't wish to make a complaint, but have questions about our products or need help with your account, please feel free to raise the question and we will be happy to assist.

Frequently asked questions

What is the difference between ExePay and banks?

We are a platform which gives you access to a UK and European IBAN account, international investment options, and premium lifestyle support services to help you better manage your financial and lifestyle needs.

Your ExePay account is an electronic money account where you can receive, hold, or send money. It's different from a bank account because:

- you won’t be able to get an overdraft

- you won’t earn any interest

Your IBAN account is facilitated by our banking partners (see Terms & Conditions). Your money is safeguarded, as opposed to protected, under a Financial Services Compensation Scheme.

What are the kind of products/services ExePay offer?

We offer e-money and payment products. The products and services are offered digitally via the ExePay website, and facilitated by our banking partners (see Terms & Conditions). We currently offer:

E-money services:

- Multi-currency account

- Transfers and payments

What type of customer do you serve?

We serve customers who have or aspire to live an internationally-mobile lifestyle, so they can manage their wealth borderlessly and with greater ease. We believe in empowering you to manage your wealth internationally and grow your portfolio.

Where can I access your services?

We allow onboarding onto the ExePay app from the following countries:

- The UK

How do I get a ExePay account?

Please apply online via our website to create an account

What is the difference between ExePay and banks?

During the account opening process, we will require you to take photos of the following via the ExePay app:

• Valid government-issued ID

• Valid proof of address (i.e. any bank statements, utility bills or phone bills issued within the last 90 days) and

• Your face (i.e., a true likeness of yourself as a 'selfie')

Please make sure that the whole document page can be seen in the photos, with your name, your residential address, the date of issue and the issuing authority information clearly shown.

Some tips to ensure that the identity verification goes smoothly:

• Do not take a photo of a photo

• Take a clear photo of your documents, where every detail is legible

• Turn the flash off to avoid glare on your documents

• Take the photos somewhere brightly lit

• Make sure your personal details on your ExePay profile match those on your legal document

• Make sure that the whole document page (including your proof of address) is captured in the photo

To ensure the safety of your account, all devices running the ExePay app must support biometrics (e.g., 'Face ID' on Apple devices).

How do I top up my ExePay account?

Your ExePay account can be topped up by bank transfer or via SWIFT and SEPA transfers.

Can I make a transfer from ExePay?

You can make a transfer in EUR/USD/GBP via local bank transfer to accounts in their respective residencies.

What currencies do you support?

We currently support transactions in USD, GBP and EUR, and will be adding more currencies onto the platform. Stay tuned for more currencies to be available later in the year.

How do I contact you?

You can contact us on any of the following channels. Note our customer service agents work 9am - 5pm UK time excluding bank holidays.

Communications received outside of our support hours will be responded to by email during the next business day.

Telephone UK +44 (0) 2034420259

Email: info@exepay.co.uk

Where is my money stored?

Your money will always be segregated from ExePay finances. Your deposits are held and safeguarded by our banking partners (see Terms & Conditions) in accordance with FCA Safeguarding regulations

What does ExePay do with my ID and other information?

We use your ID information to verify your identity. This is to comply with a financial regulation commonly known as 'Know Your Customer’ (KYC) or 'Customer Due Diligence' (CDD) which are necessary processes to verify your identity. verifying the identity of its clients. This is a common practice amongst financial institutions to protect both the businesses and their customers.

We do not use your personal information for any other purposes.

What if I forget my ExePay account password or the email associated with the account?

To reset your password, simply select "Forgot password" at the login screen and enter the associated email. Once you have received the verification email, follow the instructions to set a new password.

Can I close my ExePay account through the website?

We are sorry to see you go! Is there anything that we can do to help? Please contact our customer support via info@exepay.co.uk and we will do everything we can to assist you.

How much do you charge for your services?

See our Fees Tariff on our website.

We may adjust the prices and the range of products or services provided, but we will make sure to notify our customers prior to doing so.

What happens if I don’t have sufficient balance in my account to pay ExePay's subscription?

You should maintain your balance with us for your subscription of our service.

We reserve the right to stop providing our services to you if you are not able to maintain the balance to pay the fee.

How do I file a complaint?

We are sorry you feel the need to raise a complaint. Please send us an email us at info@exepay.co.uk and we will get back to you.

If you don't wish to make a complaint, but have questions about our products or need help with your account, please feel free to raise the question and we will be happy to assist.